An estimated $380 billion worth of oil and gas projects have been cancelled since 2014, according to a new estimate from Wood Mackenzie.

The downturn in oil prices have hit projects all around the world, and Wood Mackenzie says that 68 major projects were scrapped in 2015, which account for around 27 billion barrels of oil and natural gas.

In the latter half of 2015 when oil prices fell once again following a modest rebound in the spring, the industry pushed off 22 major projects worth 7 billion barrels of oil equivalent. “The impact of lower oil prices on company plans has been brutal. What began in late-2014 as a haircut to discretionary spend on exploration and pre-development projects has become a full surgical operation to cut out all non-essential operational and capital expenditure,” Wood Mackenzie analyst Angus Rodger said in a statement.

The cancellations will lead to dramatically lower oil production in the years ahead. An estimated $170 billion in capex spending was slashed for the period between 2016 and 2020. All told, industry cuts will translate into at least 2.9 million barrels of oil production per day (mb/d) that will not come online until at least sometime next decade.

Oilprice.com: $380 Billion In Upstream Projects Delayed As Oil Keeps Tanking

“Against a backdrop of overwhelming corporate pressure to free-up capital and reduce future spend – to the detriment of production growth – there is considerable scope for this wall of output to get pushed back further if prices do not recover and/or costs do not fall enough,” the Wood Mackenzie report concluded.

The average breakeven costs for all the projects that Wood Mackenzie surveyed stood at around $60 per barrel. Most of the projects that suffered cuts were in deepwater, which tend to suffer from much higher development costs. For example, projects in the Gulf of Mexico, offshore Nigeria and Angola will be deferred until the 2020s. Canada’s expensive oil sands has also seen investment dry up. The $380 billion in spending cuts identified far exceeded the $200 billion that Wood Mackenzie totaled in June 2015.

More cuts could be forthcoming in 2016. The report also finds that 85 percent of the greenfield projects on the drawing board have internal rates of return of 15 percent or less. The chances that they will move forward are “bleak.”

Oilprice.com: ExxonMobil’s Large Offshore Discovery Faces Political Risk

Energy analysts are falling over each other with new estimates for where the price of oil will bottom out. Goldman Sachs was one of the first to call for $20 oil last year, but now everyone is jumping on the bandwagon. Morgan Stanley says $20 oil is possible, with much of the blame put on the strength of the dollar. Standard Chartered, not to be outdone, says oil could fall to $10 per barrel.

RBS issued perhaps the most panic-inducing warning of them all, mostly because it applied to the broader state of the global economy: “sell everything except high quality bonds,” because the world is facing a “fairly cataclysmic year ahead.”

The consensus suddenly seems to be that oil will remain in the $30s, or even lower, for much of the year, despite the incessant optimism from some oil executives.

But the extended slump for oil is setting up the world for a situation in which a supply fails to meet demand in the not-so-distant future. The Wood Mackenzie report shines a spotlight on this phenomenon, which is becoming increasingly likely.

Oilprice.com: Forget $20 – Oil Prices At $8 Per Barrel In Canada

The world is oversupplied right now, by some 1 mb/d. But the industry is shelving nearly 3 mb/d in future output because of conditions today. Lasting financial damage will lead to a shortfall in investment, a slowdown in spending that could outlast the oil bust. As the years pass and that production fails to come online, demand could start to outstrip supply, potentially leading to a price spike.

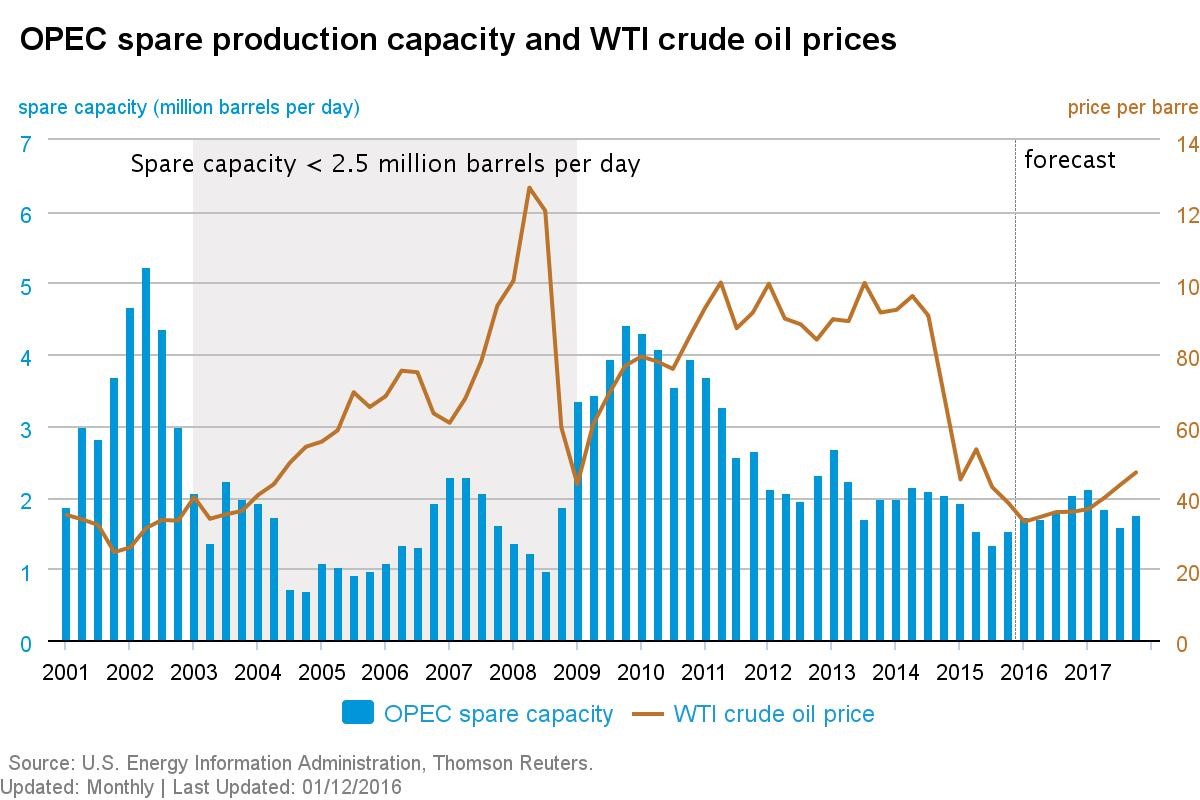

The difference between the 1980s, the last time the world had to work through a supply-side oil bust, is that today the oil markets are not as oversupplied as they seem. OPEC had several million barrels per day sitting on the sidelines in the 1980s, which were ramped up over the course of several years to incrementally match demand needs.

At this point, OPEC is producing flat out. Spare capacity hit 1.33 mb/d in the 3rd quarter of 2015 – the lowest level since 2008. It is hard to imagine a shortage when oil is dipping below $30 per barrel. But global supplies could very well tighten in the next few years.

This article originally appeared on Oilprice.com

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- The Revolution of Yulia Navalnaya

- 6 Compliments That Land Every Time

- What's the Deal With the Bitcoin Halving?

- If You're Dating Right Now , You're Brave: Column

- The AI That Could Heal a Divided Internet

- Fallout Is a Brilliant Model for the Future of Video Game Adaptations

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Contact us at letters@time.com