On the day after Christmas 2013, John Ferriola received a FedEx package containing a dozen metal pellets, each about the size of a blueberry and the color of charcoal. They had been refined with natural gas at a temperature one-fifth that of the surface of the sun. To most, the contents of the box would have looked like a heap of rubbish. To Ferriola, CEO of Nucor Corp., the tiny pellets represent a huge bet for the biggest steelmaker left in the U.S.

The technology may also help rekindle American steel manufacturing. Nearly a third of U.S. steelmaking jobs have disappeared over the past 15 years as the industry has boomed in China and other emerging economies. The lone bright spot: so-called minimills that process old scrap steel rather than making new steel from iron ore mined from the ground. Nucor, the most profitable steelmaker in the U.S., with some $20 billion in annual sales, had long been the hero of this revolution. But its success began to erode as a result of the recession and ever growing imports.

That’s why the pellets are vital. Composed of superpurified iron, known as direct-reduced iron, they act as an additive that greatly improves the quality of the finished product. Mixed in with molten steel, the pellets help produce steel that can be used in the making of car hoods or gas pipelines, for instance. Promising to make it more economical for Nucor–and other American steelmakers–to compete around the world, they may already be making a difference. On Oct. 23, the company said its third-quarter revenue had jumped 15%, to $5.7 billion, compared with the same time last year.

The pellets also represent one of the drivers of the U.S. manufacturing renaissance: cheap, homegrown energy. They could not be produced at a reasonable cost if it weren’t for abundant, inexpensive natural gas. The boom in U.S. gas production has transformed barren parts of the Dakotas into thriving towns, made U.S.-based manufacturing more profitable in industries ranging from automobiles to electronics and will ultimately help lower consumers’ energy bills across the country this winter.

There are plenty of skeptics who question how much this might improve the prospects for homemade steel. Some analysts argue that Nucor can’t hope to drive down costs far enough to compete with megaconglomerates from China and India. But if Ferriola and Nucor can pull off their plan, they will not only prove that American steel can matter on the global stage again but that U.S. manufacturing can too.

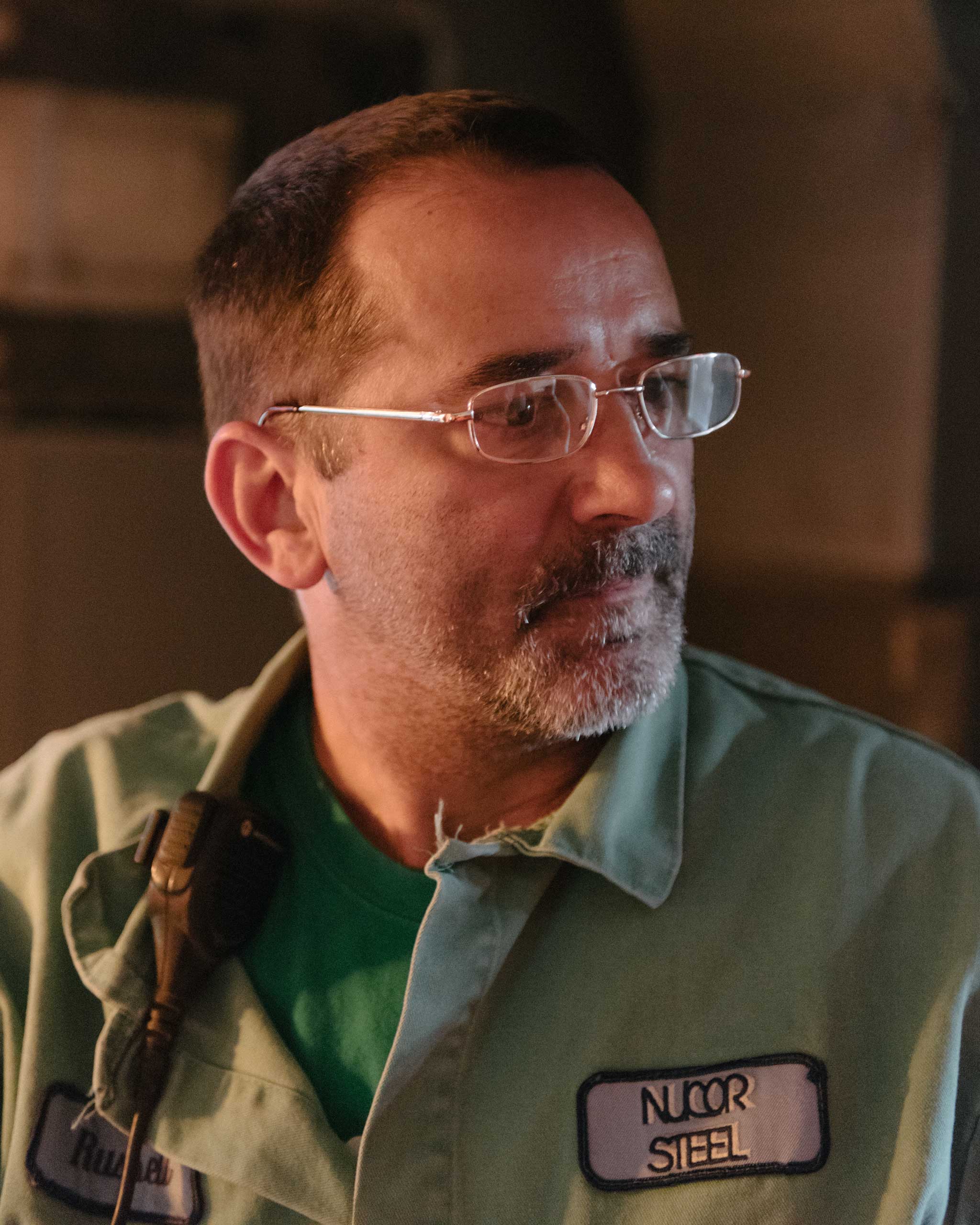

Photos: Inside an American Steel Mill

Glowing Furnace

Steelmaking is a hot and dirty business that for years supported not only entire Midwestern cities but also multiple generations of the same families. Ferriola, 62, began as an outsider. He grew up in an Italian-American family in a working-class neighborhood in outer Brooklyn. He earned a degree in electrical engineering from the State University of New York Maritime College and got his first break at Bethlehem Steel, fixing old-line manufacturing equipment, before joining Nucor in 1992. The company was then in the midst of a remarkable growth streak. It recycled steel–melting old cars, construction parts, dishwashers–which was much cheaper than mining fresh ore. Mills had long been recycling small amounts of steel, but Nucor’s approach of relying entirely on reused materials led to a sea change in the industry, and Ferriola moved up the ranks as the firm grew and became a Wall Street darling.

Nucor’s other innovations were managerial. It paid employees a smaller base salary than its competitors did, but it gave them a bonus for each ton of steel they collectively churned out. Unlike bigger steelmakers such as U.S. Steel and Bethlehem, which were crippled by rising costs and labor disputes, Nucor had no unions. “I think it’s brilliant,” says Al Fagan, a 45-year-old steelworker with elaborate sleeve tattoos, referring to the bonus system that remains one of the company’s trademarks. “You keep your people happy, and give them some motivation.”

Ferriola became known for his own motivational techniques. When he suspected production wasn’t what it could be at one mill, he walked into the control room of the melt shop–where scrap metal is liquefied–and wrote on a stairway which team had made the most steel. “I’d write, ‘A Crew was best today. Good job, A Crew,'” Ferriola recalls. “You know who that pissed off? B, C and D crew. And you know what they did? They worked their butts off to be the best the next day.” Within a month, Ferriola says, the mill saw a nearly 20% improvement in production.

Despite his ruddy smile, Ferriola can be harsh. He told a team in Memphis to finish construction on a mill by Feb. 14 or they’d risk a “second St. Valentine’s Day Massacre”–referring to the 1929 Mafia shooting in Chicago that left seven men dead. (The Nucor team had the mill finished in time.) “John was a different type of a manager,” says Ron Dickerson, who worked under Ferriola in the late 1990s. “He’s a hands-on guy.”

Ferriola’s final proving ground before making it to the executive suite was the job of general manager of Nucor’s steel mill in Crawfordsville, Ind. On a recent visit, the ceiling soars into darkness, while below furnaces glow like Jacuzzis filled with molten steel. Scrap metal is being melted at temperatures that exceed 3,000°F in massive furnaces powered by cables the size of anacondas. Slag, or molten runoff, burns so hot, it turns blue as it drips out of the furnaces. Somewhere Jimi Hendrix is playing on a radio, faintly audible amid the roar of machinery. Ferriola calls his time here “the best job I’ve ever had in my life.”

A New Hope

By the time Ferriola became CEO in 2013, Nucor’s run had started to slow. The recession hurt. Making a profit recycling steel had become more difficult. The process of reusing scrap is a lot like making tea multiple times with the same tea bag: the first few times, the purity of the steel is close to the original’s. But eventually the product is weakened. That has left Nucor and companies like it working harder to produce steel that is of the same quality, squeezing their profit margins in the process.

The pellets, which are made by scorching iron with natural gas to remove impurities, hold the key to reversing this cycle. Nucor mixes the pellets in its furnaces with old scrap. Because the pellets are so undiluted, they raise the overall purity of the finished steel. “You can’t make a silk purse out of a sow’s ear,” explains Ferriola. The process, he argues, will allow Nucor to make more of the cleanest–and most profitable–steel.

Nucor’s new $750 million Louisiana plant wouldn’t be possible without access to cheap natural gas. Steelmaking requires an enormous amount of energy, a cost that would have been prohibitive before America’s fracking boom. In 2012, Nucor inked a 20-year gas-procurement deal with the driller Encana, which will ultimately yield Nucor 140 billion cu. ft. of gas annually.

Several other American steel companies, including U.S. Steel, have said they may follow Nucor’s lead. If the technology becomes widespread, it could help make U.S. steelmaking more competitive with that of Asia, where gas is less plentiful. Many analysts on Wall Street see the plant as another revolution. “When you think about the steel industry and how mature it is, there are few opportunities,” says Andrew Lane, a steel-industry equity analyst at Morningstar. Nucor, he argues, has found one.

Ferriola’s plan has its skeptics. How much it will reduce manufacturing costs remains to be seen as the Louisiana plant increases production. “Anybody who was talking about [this] two years ago looked like geniuses” because of the high cost of alternative raw materials at the time, says Timna Tanners, an analyst at Bank of America. “In the last several years, honestly, that’s not as big a constraint.”

Ferriola says the initial results since the plant opened after Christmas are good, and Nucor has the infrastructure in place to build a second facility if need be. But the Louisiana plant operated at a loss during much of 2014, and it could be months before anybody really knows how successful it is in lowering the company’s costs.

Rivals are paying Nucor the compliment of imitation. John Correnti, a former Nucor CEO who resigned under pressure in 1999, is leading a $1.3 billion investment in a new mill in Arkansas to contest his former employer’s supremacy in the American Southeast. That has hardened Ferriola’s resolve. “You’ve got to be tenacious, a bulldog, and fight like hell,” he says. “It’s stuff you learn on the playground. But some people forget it.”

Road Ahead

Late last summer, Ferriola arrived in Crawfordsville to celebrate the 25th anniversary of Nucor’s rolled-steel mill. A few hundred steelworkers and other locals gathered in a large yellow tent outside the mill for lunch. Ferriola walked around shaking hands with employees, many of whom he’s known for 15 years or more. The mood was upbeat: Crawfordsville workers could look forward to sizable bonuses, thanks to Nucor’s announcement of better-than-expected earnings. “I can promise you as sure as I’m standing here: There will be a Nucor steel in Crawfordsville, Ind., 25 years from today,” Ferriola told the crowd. “I’m not sure what it’ll look like, but I can guarantee you this–we will be here.”

Meanwhile, he is looking for new markets. If the Louisiana plant is a success, that may allow Ferriola to expand into Central and South America. Nucor doesn’t have plants outside the U.S.–“not yet,” Ferriola says. He’s got sales teams on the ground, and they’re prospecting. He holds out his hand like a map and pretends to poke at countries he cited earlier, like Colombia, Costa Rica, Peru, Honduras and Mexico. Says Ferriola: “When you look at that whole area, you say, ‘Boy, if somebody had a place here, there, there and there, we would capture the market.'”

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- The Revolution of Yulia Navalnaya

- 6 Compliments That Land Every Time

- What's the Deal With the Bitcoin Halving?

- If You're Dating Right Now , You're Brave: Column

- The AI That Could Heal a Divided Internet

- Fallout Is a Brilliant Model for the Future of Video Game Adaptations

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Contact us at letters@time.com