Apple’s flagship product, the iPhone, is humming along nicely, according to the company’s latest quarterly earnings report, but its newest disruptive device has seen better days.

The iPad, which turned four years old in April, is suffering slowing sales on both a sequential and year-over-year basis. The product line sold 13.3 million units between April and June, down 9 percent from the same period last year. That’s bad news for a relatively new device that was supposed to be “better than a laptop” and eventually devour the PC market.

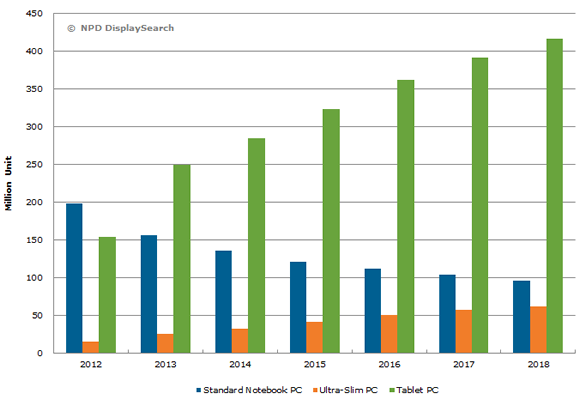

Here’s a breakdown of the product’s overall trajectory:

In the most recent quarter, the iPad saw its lowest sales since the first quarter of 2012, when it sold 11.8 million units. Many factors explain the slowdown: For one, new iPad rollouts don’t generate nearly the buzz of a new iPhone launch. Why not? The flagship device hasn’t changed dramatically since it launched in 2010—yes, it’s added a fancy retina display and gotten lighter, but those advances don’t compare to the new features that have accompanied launches of new iPhone models, like the App Store or the Siri personal assistant.

On top of that, people generally seem content to hold on to their iPads for longer than they keep their iPhones. According to mobile marketing firm Fiksu, which tracks the use of iOS on active Apple devices, the iPad 2 was still the most popular iPad in use as of April 2014, even though it had already been out for three years. For comparison, the iPhone 5, released in September 2012, is the most-used Apple smartphone.

That’s partially because iPhones are usually cheaper to purchase in the United States. Thanks to subsidies from wireless carriers, the expensive phones typically cost between $100 and $200 for U.S. customers eligible for an upgrade, while the sans-subsidy iPad starts at $399. Combine that price differential with the fact that Americans have been conditioned to seek out phone upgrades every two years when their contracts end, and it’s no wonder that the majority of iPads are now being sold to first-time tablet buyers, according to Apple.

“I don’t see the purchase cycle [for iPads] as fast as 20 to 24 months,” says Ben Arnold, an industry analyst at NPD.

Another problem for Apple is the iPad’s growing number of competitors. When the device launched in 2010, it became the first breakthrough success in the tablet category. Since then, both Amazon and Samsung have launched tablets with similar features and, in some cases, lower prices. Meanwhile, many laptops with functionality similar to an iPad are now cheaper than Apple’s tablet. Arnold attributes some of the iPad’s current woes not only to its direct competitors but also dirt-cheap netbooks like Google’s Chromebook, which is tailored for web browsing and video viewing.

On the other end of the spectrum, smartphones are slowly approaching the size of tablet — Apple itself is reportedly prepping a new iPhone with a 5.5-inch screen, just 2.4 inches off the iPad Mini. Those big phones, sometimes called “phablets,” are eating away at tablet sales across the board.

The convergent functionality of different device types means the tablet market as a whole may not have as much runway to grow as analysts previously thought. Global tablet shipments declined for the first time ever in the first quarter of 2014, according to NPD. The sales-tracking group cited the emergence of large-screen smartphones as one reason for faltering growth. NPD projects tablet shipments will rebound, but that the growth rate will be 14 percent in 2014, lower than in previous years. By 2017, the growth rate is expected to slip to single digits (NPD expects a growth rate of 13 percent for smartphones through 2017, by comparison).

“The market is kind of settling into this mature phase,” Arnold says of tablets. “The second generation purchases are slower to come.”

So Apple has a product in sales decline in a rapidly maturing market that faces growing competition from every other type of mobile computing device. What’s the solution? Apple believes it’s enterprise. In his conference call with investors, Apple CEO Tim Cook stressed that the iPad would be a key element of the company’s just-announced partnership with IBM to sell Apple products and services to businesses. Currently just 20% of tablet owners use the devices for work-related activities, according to an April survey by JD Power. Apple believes it can change this by creating apps tailored to different industries like insurance, banking and retail.

The iPad certainly isn’t going anywhere, and at more than 225 million units sold, it’s an incredibly successful device. But it’s not the next iPhone, and that’s what investors have been craving since they catapulted Apple to become the most valuable company in the U.S. Cook, who acknowledged that iPad sales were below analysts’ expectations, tried to put his aspirations for the device in perspective: “Our theory that has been there honestly since the first time that we shipped iPad, that the tablet market would eventually pass the PC market. That theory is still intact.”

More Must-Reads From TIME

- The 100 Most Influential People of 2024

- The Revolution of Yulia Navalnaya

- 6 Compliments That Land Every Time

- Stop Looking for Your Forever Home

- If You're Dating Right Now , You're Brave: Column

- The AI That Could Heal a Divided Internet

- Fallout Is a Brilliant Model for the Future of Video Game Adaptations

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Contact us at letters@time.com